Notes On The New EU VAT Rules And VAT Prepayment

Notes On The New EU VAT Rules And VAT Prepayment

SKU:VAT-prepayment

Couldn't load pickup availability

Notes in advance:

1. This note is only for customers in EU countries.

If the recipient of the order is not in an European Union country, then the new EU VAT rules will not affect the order.

2. The VAT prepayment mentioned in this note is only for the order total product value (excluding shipping cost) is less than EUR 150

*Regardless of the total order value, if you choose Express Shipping, they default to DDU mode (Delivered Duty Unpaid), so VAT prepayment is not required

For the order total product value over EUR 150, it will be sent in DDU mode (Delivered Duty Unpaid).

3. VAT prepayment is an effective method and recommended by EU customs. It will be faster and easier to pass customs, reducing the occurrence of delays

If you have any questions about this, you can check the documents related to the new VAT rules provided by the European Union.

About the new EU VAT rule

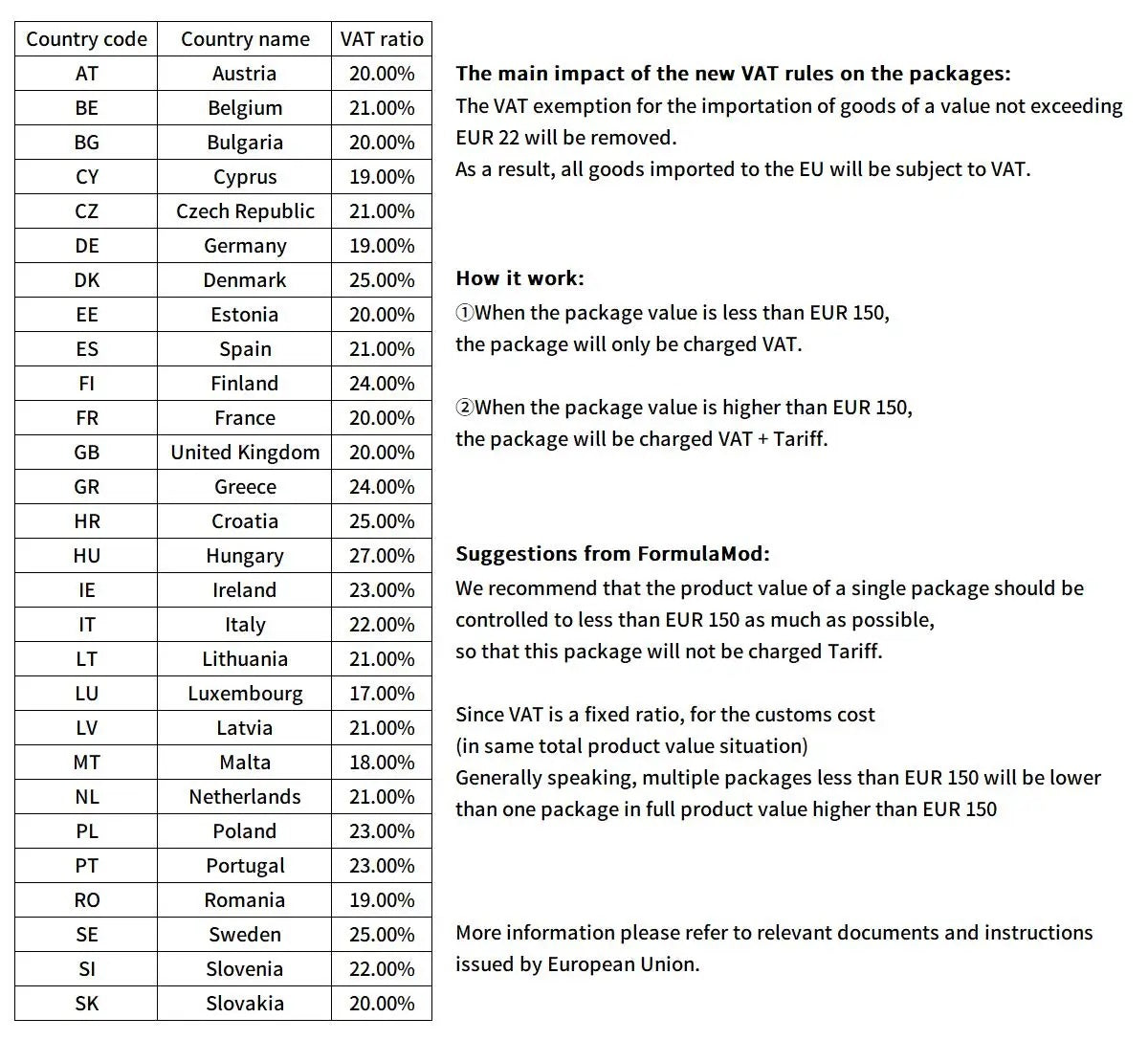

The main impact of the new VAT rules on the packages:

The VAT exemption for the importation of goods of a value not exceeding EUR 22 will be removed.

As a result, all goods imported to the EU will be subject to VAT.

How it work:

①When the package value is less than EUR 150,

the package will only be charged VAT.

②When the package value is higher than EUR 150,

the package will be charged VAT + Tariff.

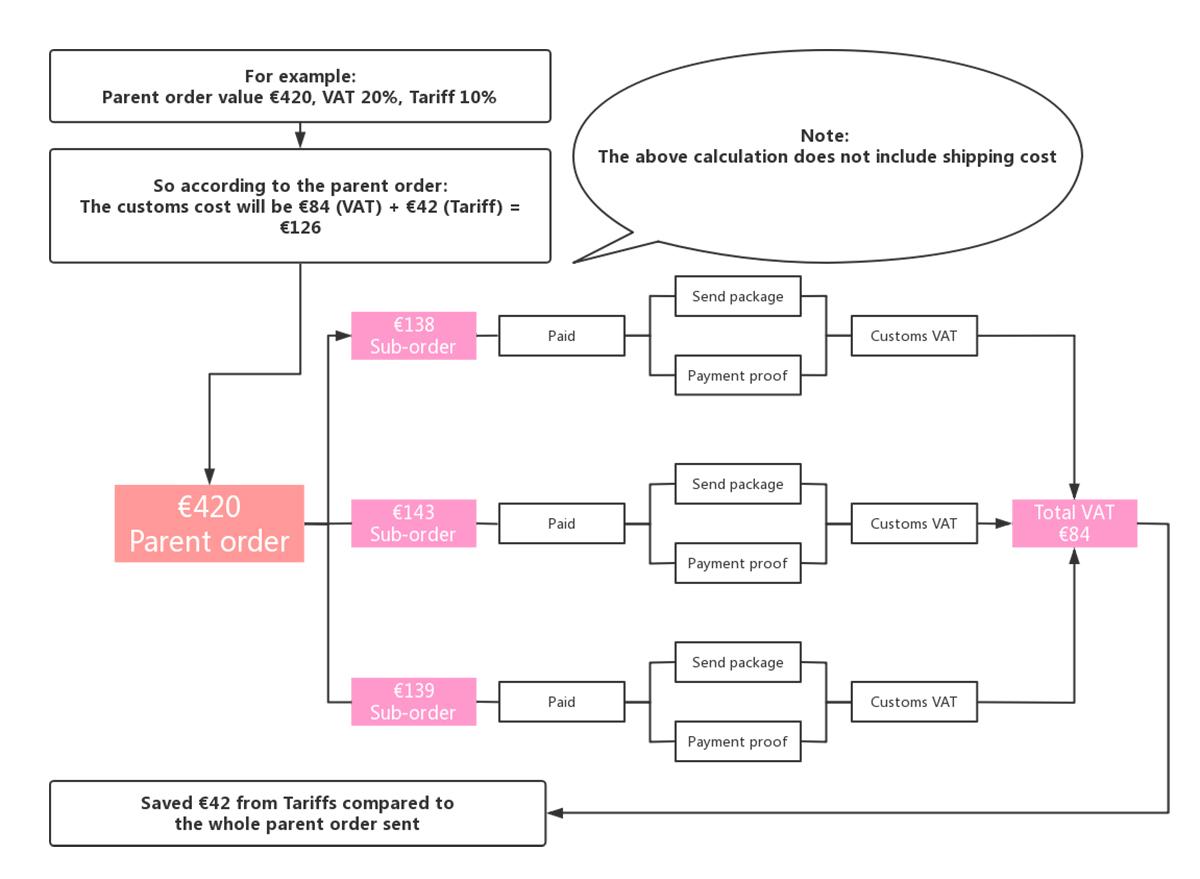

Suggestions from FormulaMod:

We recommend that the product value of a single package should be controlled to less than EUR 150 as much as possible

So that this package will not be charged Tariff.

Since VAT is a fixed ratio, for the customs cost (in same total product value situation)

Generally speaking, multiple packages less than EUR 150 will be lower than one package in full product value higher than EUR 150

About VAT prepayment

What is VAT prepayment:

When a package with product value of less than EUR 150 arrives at the customs of EU countries.

The customs will propose to collect VAT according to the value of the package.

At this time, if this package has already pre-prepared the VAT cost in advance, then the package can be passed quickly without requiring documents or other certification from the recipient or sender.

This pre-prepared VAT cost is VAT prepayment

How to calculate:

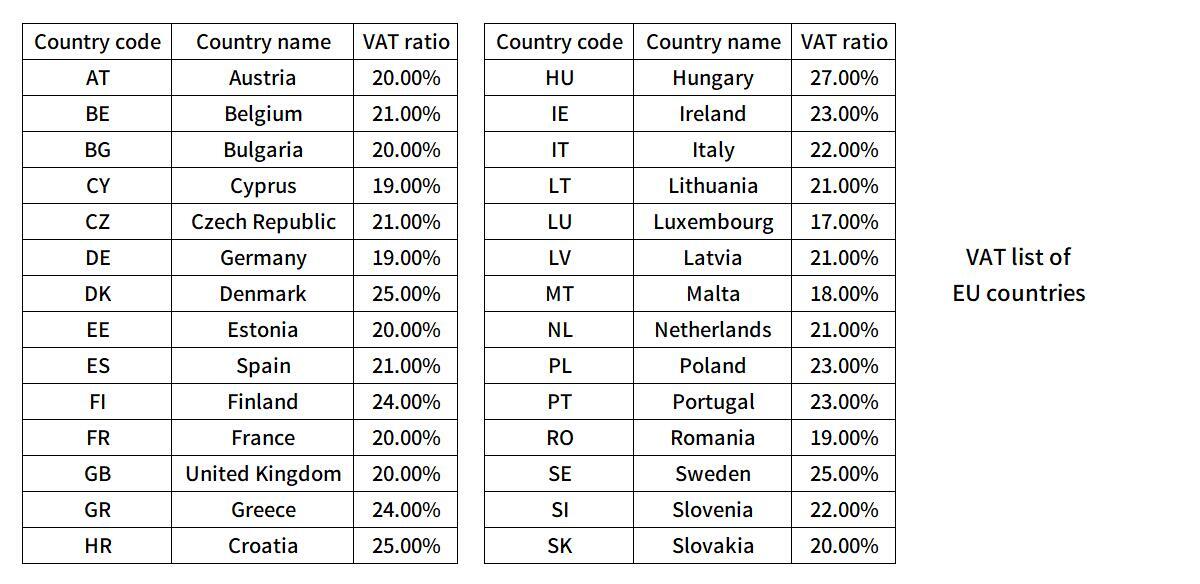

According to the VAT list of EU countries, we can already calculate the VAT price after confirming the order

VAT prepayment application scope:

The order total product value (excluding shipping cost) is less than EUR 150.

Why need VAT prepayment:

Since most of the current logistics methods for less than EUR 150 packages, they all belong to the DDP mode (Delivered Duty Paid) for EU countries.

Therefore, VAT prepayment needs to be charged in advance to be allowed to ship and as a EU customs requirement.

In response to the new EU VAT rules, our FormulaMod team has not adjusted the price and shipping cost of any products for the fairness of all customers.

Instead, we will collect VAT prepayment for EU customers before sending the package.

And then transfer this VAT prepayment to the logistics company, so that this package can be sent smoothly and passed the EU customs.

Therefore, customers in EU countries, if the value of your order is less than EUR 150,

Please pay it by yourself according to the VAT ratio (by this link) or contact us for help.

So that we are able to arrange the sending of your package as soon as possible.

Thank you for reading and cooperating with the new rules :)

Share